How GA Hard Money Lenders Can Help You Secure Fast Financing for Your Projects

How GA Hard Money Lenders Can Help You Secure Fast Financing for Your Projects

Blog Article

The Ultimate Guide to Discovering the Finest Tough Cash Lenders

From reviewing lenders' online reputations to contrasting rate of interest rates and charges, each step plays an essential function in securing the finest terms possible. As you think about these variables, it ends up being apparent that the path to recognizing the appropriate hard money lender is not as straightforward as it might seem.

Recognizing Tough Money Car Loans

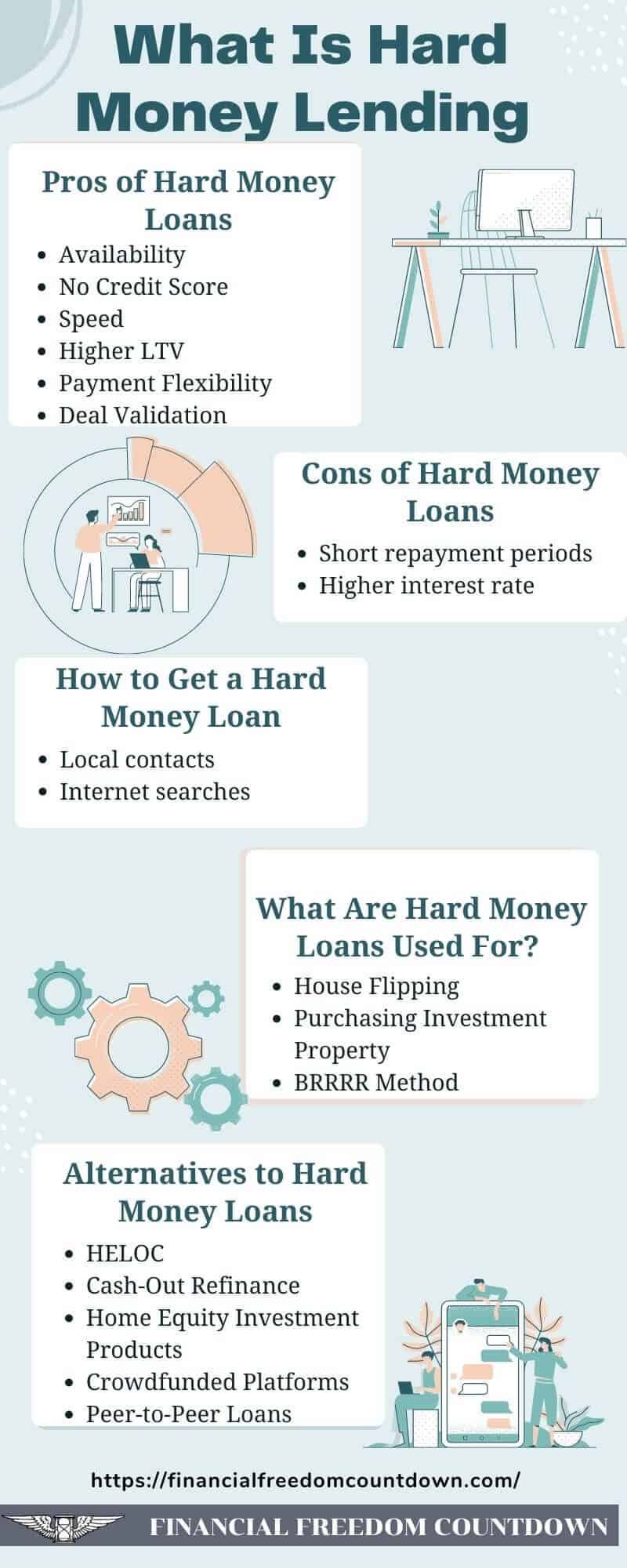

One of the defining features of hard cash finances is their reliance on the worth of the residential property instead of the borrower's credit reliability. This allows consumers with less-than-perfect credit score or those seeking expedited financing to access funding quicker. Additionally, tough money finances typically feature higher passion rates and shorter settlement terms compared to conventional loans, showing the increased danger taken by lending institutions.

These loans offer various objectives, including funding fix-and-flip projects, refinancing troubled homes, or providing resources for time-sensitive opportunities. Recognizing the subtleties of difficult cash loans is vital for capitalists that intend to utilize these financial instruments efficiently in their genuine estate ventures (ga hard money lenders).

Secret Aspects to Take Into Consideration

Following, take into consideration the terms of the loan. Different loan providers supply differing rates of interest, charges, and settlement timetables. It is essential to comprehend these terms fully to prevent any type of undesirable shocks later on. In addition, examine the lender's funding speed; a swift approval procedure can be crucial in open markets.

An additional critical factor is the loan provider's experience in your certain market. A lending institution knowledgeable about regional conditions can provide valuable understandings and could be extra versatile in their underwriting process.

Just How to Review Lenders

Reviewing difficult money lenders entails an organized technique to ensure you choose a companion that lines up with your financial investment objectives. Start by assessing the lending institution's track record within the market. Look for testimonials, testimonies, and any type of available rankings from previous clients. A credible loan provider should have a background of successful purchases and a strong network of satisfied debtors.

Following, analyze the lending institution's experience and specialization. Different loan providers might focus on different kinds of properties, such as domestic, industrial, or fix-and-flip tasks. Choose a loan provider whose experience matches your investment approach, as this knowledge can considerably affect the authorization procedure and terms.

An additional critical factor is the loan provider's responsiveness and communication style. A trustworthy lending institution ought to be eager and accessible to answer your questions comprehensively. Clear communication throughout the analysis procedure can show just how they will manage your car loan throughout its duration.

Finally, guarantee that the lender is transparent about their needs and procedures. This includes a clear understanding of the documentation required, timelines, and any kind of problems that may apply. Taking the time to evaluate these facets will certainly equip you to make a notified decision when picking a tough money lending institution.

Comparing Rates Of Interest and Costs

A detailed contrast of rates of interest and charges among tough money lenders is crucial for optimizing your investment returns. Hard cash finances typically come with higher interest prices compared to standard financing, typically ranging from 7% to 15%. Recognizing these prices will aid you evaluate the possible expenses connected with your investment.

In enhancement to rates of interest, it is important to evaluate the connected fees, which can dramatically affect the total funding cost. These charges might include source costs, underwriting fees, and closing prices, often revealed as a percent of the funding quantity. Origination charges can differ from 1% to 3%, and some loan providers might charge extra charges for handling or administrative tasks.

When contrasting lending institutions, consider the overall price of loaning, which encompasses both the interest rates and charges. This all natural approach will certainly allow you to determine the go now most economical alternatives. Furthermore, make sure to inquire regarding any type of feasible early repayment charges, as these can impact your capability to settle the financing early without sustaining added costs. Ultimately, a careful analysis of interest prices and costs will certainly cause more educated borrowing choices.

Tips for Effective Loaning

Comprehending rates of interest and costs is just part of the equation for safeguarding a difficult money loan. ga hard money lenders. To make certain successful borrowing, it is essential to completely assess your economic scenario and task the this prospective return on investment. When they recognize the intended usage of the funds., Start by plainly defining your loaning purpose; loan providers are more most likely to react favorably.

Following, prepare a thorough service strategy that describes your task, expected timelines, and monetary projections. This demonstrates to lending institutions that you have a well-thought-out method, enhancing your integrity. Additionally, keeping a strong partnership with your lender can be helpful; open interaction fosters depend on and can bring about much more positive terms.

It is additionally important to make certain that your residential or commercial property meets the loan provider's standards. Conduct a thorough evaluation and supply all called for documentation to simplify the approval process. Finally, be conscious of leave approaches to settle the car loan, as a clear payment strategy comforts lending institutions of your dedication.

Final Thought

In summary, finding the most effective difficult money loan providers requires an extensive assessment of different aspects, including lender online reputation, loan terms, and specialization in residential or commercial property types. Effective analysis of lending institutions via comparisons of rate of interest rates and costs, incorporated with a clear service plan and solid communication, enhances the likelihood of desirable loaning experiences. Eventually, diligent study and tactical engagement with lenders can bring about successful financial results in property undertakings.

Furthermore, hard cash finances normally come with higher passion rates and much shorter payment terms compared to traditional car loans, mirroring the boosted risk taken by lending institutions.

Report this page